Thank you for taking into account this article on Is Leadpages Good For SEO for your needs.

Leadpages provides a variety of purdy templates to help you grow your e-mail list. The platform likewise has tools to test your pages for conversions. Its reliable analytics help your group determine what jobs best.

This advertising device additionally integrates with marketing automation software program such as Infusionsoft, Salesforce and digital advertising systems like Facebook Ads and WebinarJam. You can also request an assimilation via the Zapier functionality.

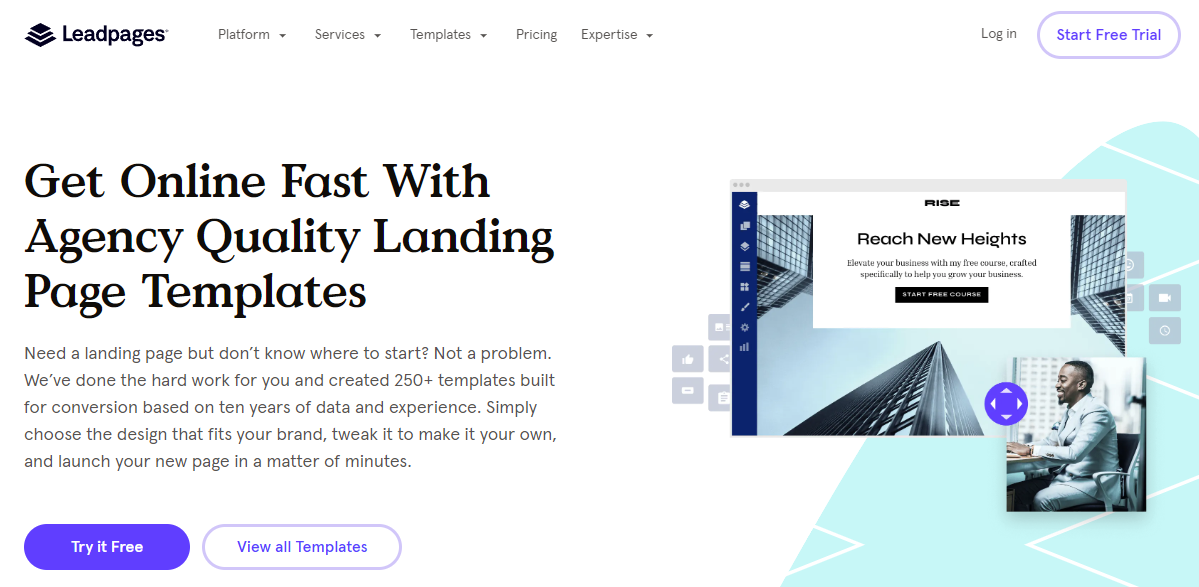

High-converting landing pages

Leadpages enables local business to develop high-converting landing pages that straighten with their advertising strategies and goals. The platform provides a wide array of design templates for different markets and conversion-driven functions like sticky bars and popups that can be utilized to record leads. It likewise aids marketers maximize their pages making use of A/B testing and conversion understandings.

The system’s layout library is categorized by market, campaign kind and desired functions to assist customers discover the best one for their requirements. Each theme incorporates style components and copywriting approaches that have been confirmed to drive conversions. Moreover, each web page is designed to be mobile-responsive and easily adjusts to various display dimensions.

There are 2 ways to construct your landing pages with Leadpages: its drag-and-drop editor and its basic editor. The drag-and-drop editor is easy to use and can be customized with your own photos and message. Nonetheless, several customers have whined that it is not receptive to changes and has difficulty centering material or readjusting column dimensions.

Leadpages likewise has integrations with numerous other software devices, including e-mail advertising and marketing platforms, CRM systems, social media networks and settlement portals. This enables you to automate the process of following up with your leads and turning them right into qualified sales. Furthermore, the system supports e-commerce for marketing digital services and products. It also sustains multiple languages, making it simple for companies in other nations to utilize the platform.

Produce pop-ups

Leadpages enables you to develop pop-ups that are high-converting opt-in forms on your internet site. You can make use of these to collect email addresses from your visitors and grow your checklist. These can be triggered immediately, or by clicking a switch, picture, or web link. You can additionally tailor your pop-ups to match the motif of your internet site.

When you initially sign up for Leadpages, the system will ask you a series of concerns concerning your business and objectives. It will certainly then suggest a selection of templates for you to select from. These design templates are classified by their type and purpose, and will certainly aid you begin with your project. When you’ve selected a design template, you can add your own pictures and duplicate to tailor it. You can also include video clips to enhance involvement and conversions.

You can likewise link your Leadpages account to your e-mail marketing company to instantly record leads and support them via the sales funnel. This makes it less complicated to track and examine your project’s success.

The software program uses two regular paid plans and an unique Advanced plan. It likewise has a 14-day free trial, however you have to enter your credit card details to begin it. You can likewise pick to pay monthly or yearly. This is an excellent choice for small businesses, but you must consider your budget and requires before choosing a plan.

Create types

Create vibrant types to capture leads on autopilot. With our dedicated kind and calculator home builder, you can easily customize and develop high-converting kinds that mix seamlessly with your Leadpages landing pages. No coding skills are needed and you can create and launch your forms in minutes, not hours.

To begin, log right into your Leadpages account and choose a template that you would certainly such as to modify. The templates are organized right into classifications, such as landing pages, webinars and sales pages. As soon as you’ve chosen a layout, it will certainly open in the drag-and-drop editor. You can click any type of page component to see a little setups panel and modify it with your preferred alternatives.

Among the most essential attributes of Leadpages is its integrations. The platform has 13 indigenous and thousands of third-party integrations via Zapier, permitting you to do more with your online business. The platform likewise integrates with e-mail company like Mailchimp and Infusionsoft, in addition to digital advertising and marketing systems such as Facebook Ads and GoToWebinar.

The system is easy to use and provides a range of templates for numerous kinds of organizations. It is ideal for people who wish to grow their e-mail lists and transform more site visitors right into paying customers. In addition, it’s excellent for consultants who wish to promote their services or products and grow their checklist of clients. It is also easy to set up and maintain a site with Is Leadpages Good For SEO, making it the best option for novices to the online marketing world.

Develop webinars

Leadpages has a webinar function that permits customers to develop and run their own webinars. This can be valuable for introducing products and presenting brand-new features. It additionally allows customers to raise the variety of participants at events and boost their conversion prices. To make use of the webinar attribute, a user should first establish an account with among the complying with carriers:

Webinars are an effective means to enlighten possible clients and help them get started with your item. The trick is to concentrate on providing value to your audience. This will motivate people to attend your event and ultimately buy your item. As an example, a countdown timer on your webinar can motivate viewers to sign up today.

The system provides a collection of top quality design templates to choose from. The design has actually boosted for many years, but it still drags competitors like Unbounce and Instapage in regards to top quality. It additionally features limitless A/B screening, which is a good enhancement. Additionally, the platform is GDPR and CCPA certified and sustains Facebook and Google Analytics integration. It additionally integrates with email marketing software application systems, such as ActiveCampaign, HubSpot, Marketo and Is Leadpages Good For SEO, and has a special Leaddigits feature that permits website visitors to register in your listing by message messaging.